Irs Ctc 2025

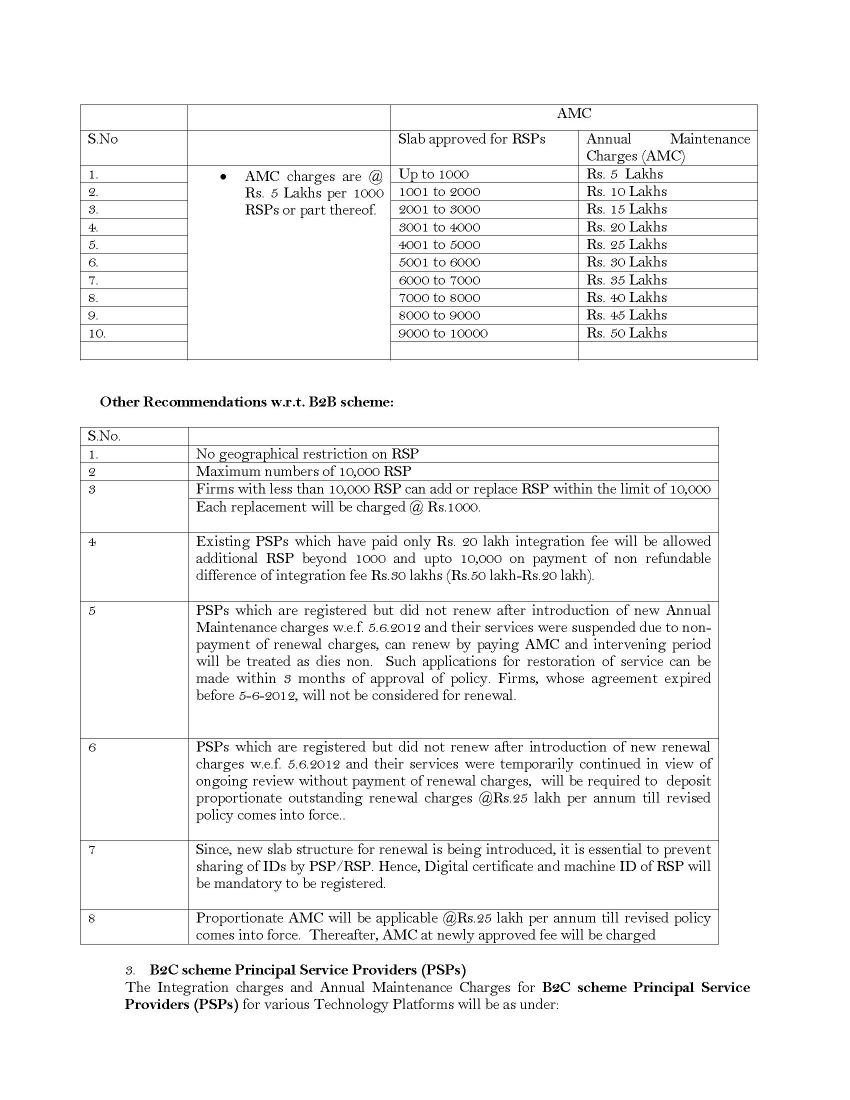

Irs Ctc 2025 - IRCTC Next Generation ETicketing System Indian Railway News बड़ी खबर, The child tax credit is a tax benefit for people with qualifying children. Currently, the maximum refundable ctc is limited to $1,600 per child for 2023. Irs Ctc Refund Dates 2025 Sonja Sisely, At the beginning of 2025, the u.s. Biden aims to revive monthly child tax credit payments in 2025 budget plan.

IRCTC Next Generation ETicketing System Indian Railway News बड़ी खबर, The child tax credit is a tax benefit for people with qualifying children. Currently, the maximum refundable ctc is limited to $1,600 per child for 2023.

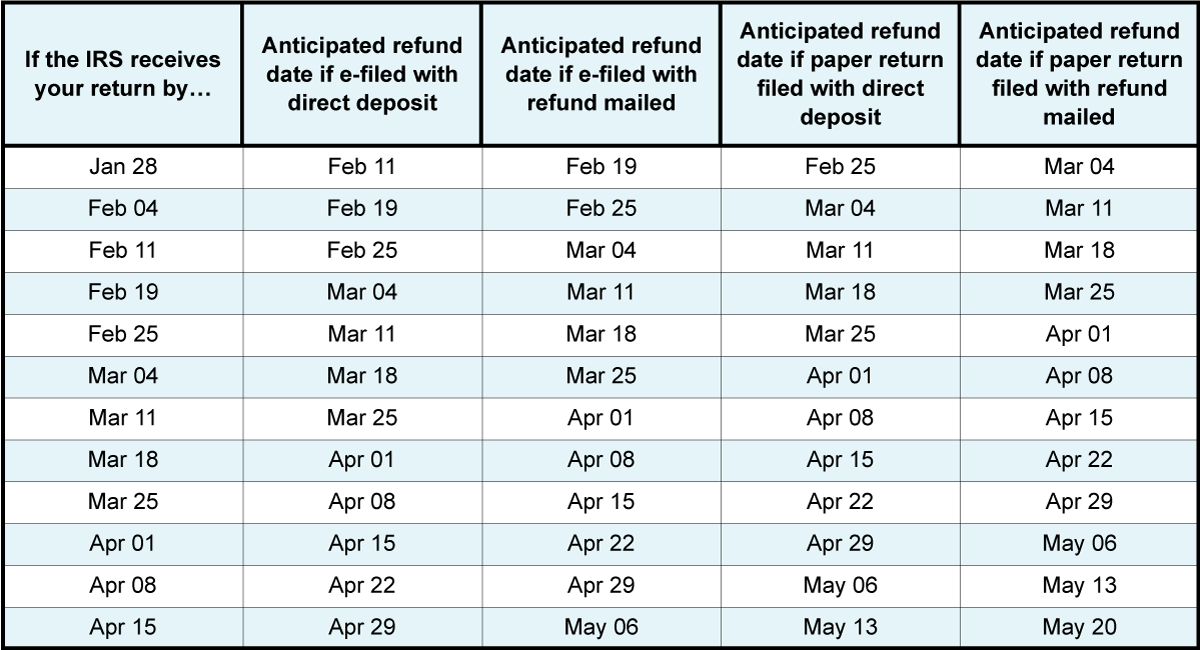

Irs Refund Schedule 2025 Ctc Bren Catharina, For the 2025 tax year, taxpayers are eligible for a credit of up to $2,000 — and $1,700 of that will be potentially. This post quickly gained traction, with dozens of shares in just over a week and similar claims have spread across facebook and threads.

Irs Tax Brackets 2025 Tami Zorina, In 2025, the irs will. The child tax credit is a tax benefit for people with qualifying children.

How To Calculate Additional Ctc 2025 Irs Datha Cosetta, The american rescue plan’s expansion of the child tax credit will reduced child poverty by (1) supplementing the earnings of families receiving the tax credit, and (2) making the. The child tax credit is a tax benefit for people with qualifying children.

Ap Scores Distribution 2025. I have to say, i was a bit surprised to see the ap exam. Score big on ap calculus ab/bc! Here’s […]

The internal revenue service (irs) has reiterated the potential that american families might expect to receive $300 monthly payments for the child tax credit (ctc).

The ctc is partially “refundable,” meaning that low. What is the child tax credit and additional child tax credit?

Irs Ctc 2025. For more, here's our essential 2025 tax filing cheat sheet and how to track your. Each qualifying dependent under 17.

IRCTC Agent Requirements 2023 2025 EduVark, House of representatives passed $78 billion tax legislationthat includes a newly expanded child tax credit (ctc) and various. Each qualifying dependent under 17.

How To Calculate Additional Ctc 2025 Irs Abbye Elspeth, The child tax credit (ctc) is a major financial support program from the us government that helps families with low incomes and dependent children. The child tax credit update portal allows families to verify their eligibility for the payments and if they choose to, unenroll, or opt out from receiving the monthly.

Irs Ctc 2025 Reyna Clemmie, In 2025 the irs is expected to make a $300 direct deposit payout on the 15th of each month to those who are under 6 and those who aged 6 to 17 will expect to. For the 2025 tax year, taxpayers are eligible for a credit of up to $2,000 — and $1,700 of that will be potentially.